Scam Alerts

The Scam

Alerts page is designed to provide quick, brief updates on the latest scams.

Some of the topics will not deserve a page to themselves because they are so

small, whereas others will be covered in more detail elsewhere on the site.

The latest warnings are at the top of the page, and older items will drop

off the bottom into the archive links listed at the end of this page.

Bookmark this page and come back often

to read the updates.

CryptoWall Ransomware Schemes

Ransomware continues to spread and is infecting devices around the world. Recent IC3 reporting identifies CryptoWall as the most current and significant ransomware threat targeting individuals and businesses.

The financial impact to victims goes beyond the ransom fee itself, which is typically between $200 and $10,000. Many victims incur additional costs associated with network mitigation, network countermeasures, loss of productivity, legal fees, IT services, and/or the purchase of credit monitoring services for employees or customers.

Between April 2014 and June 2015, the IC3 received 992 CryptoWall-related complaints, with victims reporting losses totaling over $18 million.

These financial fraud schemes target both individuals and businesses, are usually very successful, and have a significant impact on victims. The problem begins when the victim clicks on an infected advertisement, email, or attachment, or visits an infected website. Once the victim’s device is infected with the ransomware, the victim’s files become encrypted. In most cases, once the victim pays a ransom fee, he or she regains access to the files that were encrypted.

Most criminals involved in ransomware schemes demand payment in Bitcoin.

Criminals prefer Bitcoin because it's easy to use, fast, publicly available,

decentralized, and provides a sense of heightened security/anonymity.

Tips to protect yourself:

• Always use antivirus software and a firewall. It's important to obtain and use antivirus software and firewalls from reputable companies. It's also important to continually maintain both of these through automatic updates

• Enable popup blockers. Popups are regularly used by criminals to spread malicious software. To avoid accidental clicks on or within popups, it's best to prevent them from appearing in the first place

• Always back up the content on your computer. If you back up, verify, and maintain offline copies of your personal and application data, ransomware scams will have limited impact on you. If you are targeted, instead of worrying about paying a ransom to get your data back, you can simply have your system wiped clean and then reload your files

• Be skeptical. Don’t click on any emails or attachments you don't recognize, and avoid suspicious websites altogether.

If you receive a ransomware popup or message on your device alerting you to an infection, immediately disconnect from the Internet to avoid any additional infections or data losses. Alert your local law enforcement personnel and file a complaint at www.IC3.gov.

Gift Card Scam

The online presence of the Secondary Gift Card Market has grown significantly in recent years and provides a venue for consumers to resell unwanted gift cards. However, criminal activity has been identified through sites facilitating such exchanges.

There are both online and in-store venues for reselling gift cards. Kiosks and pawn shops are an option for consumers who prefer to handle a transaction in person. Secondary Gift Card Market websites exist to exclusively buy and sell gift cards.

Some of the various types of gift card scams reported are as follows:

- Victim sells a gift card on an auction site, receives payment for the sale, and sends the PIN associated with the gift card to the buyer, who disputes the charge after using the gift card

- Victim purchases an item on an auction site and is advised by the seller to purchase gift cards to pay for the transaction. After purchasing thousands of dollars in gift cards, the victim finds out the auction transaction is a scam

- A Secondary Gift Card Market site agrees to pay a victim for a discounted merchant gift card. The victim sends the code on the gift card, and the payment for the transaction was reversed. Thus, the buyer uses the gift card code to purchase an item and stops payment to the seller.

Consumers should beware of social media postings that appear to offer vouchers or gift cards, especially sites offering deals too good to be true, such as a free $500 gift card. Some fraudulent offers may pose as Holiday promotions or contests. The fraudulent postings often look as if a friend shared the link. Often these scams lead to online surveys designed to steal personal information. Never provide your personal information to an unknown party or untrustworthy website.

Tips to Prevent Gift Card Fraud:

Consumers can take several steps to protect themselves when buying and selling gift cards in the Secondary Gift Card Market, as listed below:

- Check Secondary Gift Card Market website reviews and only buy from or sell to reputable dealers

- Check the gift card balance before and after purchasing the card to verify the correct balance on the card

- The re-seller of a gift card is responsible for ensuring the correct balance is on the gift card, not the merchant whose name is on the gift card

- When selling a gift card through an online marketplace, do not provide the buyer with the card’s PIN until the transaction is complete. Online purchases can be made using the PIN without having the physical card

- When purchasing gift cards online, be wary of auction sites selling gift cards at a discount or in bulk

- When purchasing gift cards in a store, examine the protective scratch-off area on the back of the card for any evidence of tampering

Fake Government Websites

There have been complaints regarding criminals hosting fraudulent government services websites in order to acquire Personally Identifiable Information and to collect fraudulent fees from consumers.

The victims are having their Personally Identifiable Information data compromised which may be used by criminals for any number of other illegal activities, ranging from the creation of fraudulent IDs and passports to fraudulent loans and tax refunds. The Personally Identifiable Information can include the victim’s name, address, phone number, e-mail address, social security number, date of birth, and mother’s maiden name.

This is how the scheme usually works: victims use a search engine to search for government services such as obtaining an Employer Identification Number or replacement social security card. The fraudulent criminal websites are the first to appear in search results, prompting the victims to click on the fraudulent government services website. The victim completes the required fraudulently posted forms for the government service they need.

The victim submits the form online, believing they are providing their Personally Identifiable Information to government agencies such as the Internal Revenue Service, Social Security administration, or similar agency based on the service they need.

Once the forms are completed and submitted, the fraudulent website usually requires a fee to complete the service requested. The fees typically range from $29 to $199 based on the government service requested. Once the fees are paid the victim is notified they need to send their birth certificate, driver’s license, employee badge, or other personal items to a specified address.

The victim is then told to wait a few days to several weeks for processing. By the time the victim realizes it is a scam, they may have had extra charges billed to their credit/debit card, had a third-party designee added to their Employer Identification Number card, and never received the service(s) or documents requested.

Additionally, all of their Personally Identifiable Information data has been compromised by the criminals running the websites and can be used for any number of illegal purposes. The potential harm gets worse for those who send their birth certificate or other government-issued identification to the scammer.

Follow-up calls or e-mails to the scammers are normally ignored and many

victims report the customer service telephone numbers provided are out of

service. The FBI recommends that consumers ensure they are communicating or

requesting services/merchandise from a legitimate source by verifying the

entity. When dealing with government websites, look for the .gov domain

instead of a .com domain (e.g. www.ssa.gov and not www.ssa.com).

Below are some consumer tips when using government services or contacting agencies online:

- Use search engines or other websites to research the advertised services or person/company you plan to deal with

- Search the Internet for any negative feedback or reviews on the government services company, their Web site, their e-mail addresses, telephone numbers, or other searchable identifiers

- Research the company policies before completing a transaction

- Be cautious when surfing the Internet or responding to advertisements and special offers

- Be cautious when dealing with persons/companies from outside the country

- Maintain records for all online transactions.

Tax Return Fraud

Criminals are very good at stealing the personally identifiable information of individuals to carry out various fraud activities, including using stolen identity information to file fraudulent tax returns.

Once the scammers obtain victim information they electronically file tax returns and set up pre-paid debit cards or bank accounts to route fraudulent returns. The balances on the pre-paid cards and bank accounts are depleted shortly after the tax refund is issued.

The fraudsters utilize multiple methods to obtain the information needed to file a tax return. The most popular methods include: computer intrusion, the online purchase of stolen information, the recruitment of insiders who have legitimate access to sensitive information, the physical theft of computers that contain the information, the impersonation of Internal Revenue Service personnel, and the collection of information that is obtained through multiple publicly available Web sites.

Recently the cyber criminals have also targeted and compromised legitimate online tax software accounts of individuals. Cyber criminals conducting this scheme modify victims’ bank accounts to divert transfers to bank accounts or pre-paid cards under their control.Victims who filed complaints with the Internet Crime Complaint Center (IC3) reported they discovered they were victims of tax refund fraud when they tried to file a return and were notified by the Internal Revenue Service that their Social Security Numbers had already been used to file a tax return.

One individual reported that due to an error in direct deposit account information submitted on his return, he was issued a check. However, the victim had not yet filed a return. Others reported before they filed their return, they received notification that their returns were being audited or were under review.

A recent investigation identified a tax refund fraud ring responsible for filing approximately 644 fraudulent tax returns totalling over $1.9 million in attempted fraud. Using fraudulently obtained information, the fraudsters submitted tax returns and requested the funds be deposited into bank accounts under their control.

The group recruited college students to open accounts to collect the tax refund monies. The students withdrew funds via ATMs and counter withdrawals. The students then passed the majority of the funds to another group member and kept a portion of the refund as payment for the use of their bank accounts to conduct the scheme.

If you believe you have been a victim of this scam, you should reach out

to your local IRS or FBI field office, and you may file a complaint with the

IC3 at www.IC3.gov.

Tips to protect yourself:

* Monitor your credit statements for any fraudulent activity

* Report unauthorized transactions to your bank or credit card company as soon as possible

* Review a copy of your credit report at least once a year

* Be cautious of scams requiring you to provide your personal information

* Do not open email or attachments from unknown individuals

* Never provide credentials of any sort via email. This includes clicking on links sent via email * Always go to an official website

* If you use online tax services, double check to ensure your bank account is accurately listed before and after you file your tax return

* Ensure accounts that are no longer being utilized are properly deleted or scrubbed of sensitive information. Allowing online accounts to become dormant can be risky and make you more susceptible to tax fraud schemes.

Order Notification Emails

A series of 'order notification' emails are currently hitting inboxes. The emails thank you for purchasing and claim that your order is being processed. The emails do not name the company that supposedly sent the notifications. Nor do they say what product or service was supposedly purchased.

However, they do include an order total amounting to several thousand dollars along with an order number, order date and customer email address. They suggest that people check the attached file to find out more information about the purchase. The emails are formatted fairly professionally and may appear to be genuine at first glance.

Details such as subject lines, order totals, and attachment names may vary in different versions of the emails. Some have the subject line 'Urgent Notice'. Others may have the subject line 'Important Notification'.

However, the emails are not genuine order notifications and the order details included are not valid. The criminals responsible for the emails hope that at least a few recipients - panicked into believing that a large purchase has been made in their names - and will open the attachment without due caution.

However, the attached .zip file contains malware. If you unzip the attachment and then click the file inside, the malware may be installed on your computer.

The behaviour of the malware may vary based on the specific goals of the criminals who send it. The malware may collect sensitive information from the infected computer and relay it to scammers. It may also download further malware, and join the computer to a botnet.

Fake order receipt emails are a very common means of distributing malware. Be wary of any unsolicited email that claims to contain information regarding a purchase you know nothing about. If you receive such an email do not click any links or open any attachments that it contains.

Scammers May Use Paris Terrorist Attack to Solicit Fraudulent Donations

In the wake of the terrorist attack against Charlie Hebdo in Paris last month, the FBI is warning the public about fraudulent solicitations of donations for victims.

These solicitations come in many forms, such as crowdfunding platforms, e-mail campaigns, or cold calls, and scammers may divert some or all of the funds for their own use.

A number of charities and crowdfunding campaigns have already begun soliciting donations. In general individuals and businesses should be wary of suspicious e-mails, telephone calls, or websites that solicit donations in response to any event.

Crowdfunding—soliciting money from a large number of people primarily over the Internet—offers scammers a new venue to easily solicit funds with minimal oversight. Red flags to look out for include:

- The charity refuses to provide detailed information about its organization or how the donation will be used

- The charity uses a name closely resembling that of a reputable organization

- The charity pressures individuals to donate immediately

- The charity asks for donations to be sent through wire transfers, cash or virtual currency

- The charity guarantees a monetary return for a donation

The presence of one or more of these behaviours does not conclusively mean a charity is fraudulent; however, individuals and businesses should always verify a charity’s legitimacy before making any donations.

Donation Overpayment Scheme

There have been numerous complaints from businesses, charitable organizations, schools, universities, health related organizations, and non-profit organizations, reporting an online donation scheme.

The complaints reported subjects who had donated thousands of dollars, via stolen credit cards. Once donations were made, the subjects immediately requested the majority of the donation back, but credited to a different card. They claimed to have mistakenly donated too much by adding an extra digit to the dollar amount [i.e., $5000 was ‘accidentally’ entered instead of $500].

However, not many complainants actually returned the money to the second credit card.

Many, through their own investigations, discovered the original card was stolen, or the credit card company notified them of such. Also, some of the organizations’ policies did not allow funds to be returned to a different credit card.

Holiday Season Tips

If the deal sounds too good to be true, it probably is.

A reminder to shoppers in advance of the holiday shopping season to beware of cyber criminals and their aggressive and creative ways to steal money and personal information. Scammers use many techniques to defraud consumers by offering too good to be true deals via phishing e-mails advertising brand name merchandise, quick money making offers, or gift cards as an incentive to purchase a product. Remember, if the deal looks too good to be true, it probably is and never provide your personal information to an unknown party or untrusted website.

Scammers often use e-mail to advertise hot-ticket items of the year that may become hard to find during the holidays to lure unsuspecting consumers to click on links. Steer clear of untrusted sites or ads offering items at unrealistic discounts or with special coupons. You may end up paying for an item, giving away personal information and credit card details, and then receive nothing in return, along with your identity compromised. These sites may also be offering products at a great price, but the products being sold are not the same as the products they advertise. This is known as the bait and switch scam.

Beware of posts on social media sites that appear to offer vouchers or gift cards, especially sites offering deals too good to be true, such as a free $500 gift card. Some may pose as holiday promotions or contests. It may even appear one of your friends shared the link with you. If so, it is likely your friend was duped by the scam after it was sent to them by one of their friends. Oftentimes, these scams lead to online surveys designed to steal personal information. Remember, if the deal looks too good to be true, it probably is. And never provide your personal information to an unknown party or untrusted website.

When purchasing gift cards online, be wary of auction sites selling discounted or bulk offers of gift cards. When purchasing gift cards in the store, examine the protective scratch off area on the back of the card to see if it has been tampered with.

Be on the lookout for mobile applications designed to steal your personal information from your smartphone. Such apps are often disguised as games and are often offered for free. Research the company selling or giving away the app and look online for third party reviews before installing an app from an unknown source.

Tickets to theatre, concerts, and sporting events are always popular gifts during the holidays. If you purchase or receive tickets as a gift, do not post pictures of the tickets to social media sites. Protect the barcodes on tickets as you would your credit card number. Fraudsters will create a ticket using the barcode obtained from searching around social media sites and resell the ticket. You should never allow the barcode to be seen on social media.

If you are in need of extra cash at this time of year, beware of sites and posts offering work you can do from the comfort of your own home. Often, the work from home opportunities rely on convenience as a selling point for applicants with an unscrupulous motivation behind the posting. You should carefully research the job posting and individuals or company contacting you for employment.

As a consumer, if you feel you are a victim of an Internet-related crime, you may file a complaint with the FBI’s Internet Crime Complaint Center at www.IC3.gov.

Tips

Here are some additional tips you can use to avoid becoming a victim of cyber fraud:

- Check your credit card statement routinely

- Protect your credit card numbers from “wandering eyes”

- Do not respond to unsolicited (spam) e-mail

- Do not click on links contained within an unsolicited e-mail

- Be cautious of e-mail claiming to contain pictures in attached files, as the files may contain viruses. Only open attachments from known senders. Scan the attachments for viruses if possible

- Avoid filling out forms contained in e-mail messages that ask for personal information

- Always compare the link in the e-mail to the link you are actually directed to and determine if they actually match and lead you to a legitimate site

- Log on directly to the official website for the business identified in the e-mail, instead of “linking” to it from an unsolicited e-mail. If the e-mail appears to be from your bank, credit card issuer, or other company you deal with frequently, your statements or official correspondence from the business will provide the proper contact information

- If you are requested to act quickly or there is an emergency, it may be a scam. Fraudsters create a sense of urgency to get you to act quickly

- Verify any requests for personal information from any business or financial institution by contacting them using the main contact information on their official website

- Remember if it looks too good to be true, it probably is.

False Advertisements

Be aware of criminals targeting online consumers by posting false advertisements for high priced items such as automobiles, boats, heavy equipment, recreational vehicles, lawn mowers, tractors, and other similar items.

The scam initiates when the criminals post a false advertisement offering the item for sale. The advertisement usually includes a fraudulent photo to entice the consumer to purchase the item. Within the advertisement, the criminal includes a contact telephone number. The consumer leaves a message and the scammer responds via text message.

The text message normally requests that the consumer provide an e-mail address. Once the e-mail address is provided the consumer is sent additional details to include multiple images of the item for sale. The scammer provides logical reasons for offering the item at such a discounted price such as moving to another location; therefore, the item needs to be sold quickly; the sale was part of a divorce settlement; or overseas deployment.

Consumers normally negotiate a price. Many scammers advise the consumer the transaction will be conducted through Ebay to ensure a safe and easy transaction. In reality the scammer is only pretending to use Ebay. The consumer receives a false e-mail that appears to be legitimate from Ebay.

The e-mail provides instructions on how to complete the transaction. The scammer provides the consumer with all the information necessary to complete the wire transfer - the bank account name, address, and account number. The scammer provides a fraudulent toll-free Ebay customer service number for the consumer to use when they are ready to wire the money.

These numbers were also used by many victims to confirm a successful wire transfer or to check transaction status and shipping information. After the transaction, the consumer is sent a false Ebay confirmation e-mail that includes the fraudulent transaction or confirmation number and the expected delivery date of the item.

Any follow-up calls, text messages or e-mails to the scammer(s) are normally ignored and many victims report the toll-free customer service telephone numbers provided are constantly busy. As a result, the consumer never receives the purchased item(s) and suffers a financial loss.

Consumers are advised to ensure they are purchasing the actual merchandise from a reputable source by verifying the legitimacy of the seller. Below are some consumer tips when purchasing items online:

- Use search engines or other websites to research the advertised item or person/company selling the item

- Search the Internet for any negative feedback or reviews on the seller, their e-mail addresses, telephone numbers, or other searchable identifiers

- Research the company policies before completing a transaction. For example, ensure the seller accepts payments via credit card as Ebay does not conduct wire transfers and only uses PayPal to conduct transactions

- Be cautious when responding to advertisements and special offers

- Be cautious when dealing with persons/companies from outside the country

- Maintain records for all online transactions

Green Dot MoneyPak Customer Support Scam

There have been numerous complaints reporting fraudulent websites posing as MoneyPak customer support. MoneyPak is a non-reloadable, prepaid product offered by Green Dot.

Complaints indicate victims locate the websites via Internet search engines. Interaction between the victims and the fraudulent customer support generally occurs via telephone. There have been variations of this scam.

- The victim is seeking a refund from an already purchased MoneyPak card and contacts the information listed on the website. A customer service “representative” will ask the caller to provide the identification number of the prepaid card. ◦Example – The victim loaded funds onto a MoneyPak card and now wishes to receive a refund of those funds off of the prepaid card. The representative will ask for the prepaid card number and a credit card or checking account number to which the refund can be processed. At this point, the scammer has access to the funds on the prepaid card and the victim’s personal account.

- Victim seeks support in connection with loss from other possible scams. The representative will instruct the caller to re-load the card with additional funds equal to the previously lost amount. ◦Example – The victim lost $500 from their MoneyPak card to a separate scam and is seeking a refund to the card. The representative will instruct the victim to load an additional $500 to the card. The representative states “re-loading is the only way to process the refund”, and the card will be refunded the full $1,000. Should the victim refuse to re-load the card, the representative will promptly disconnect the call.

In most complaints, victims are given a tracking or confirmation number in connection with their call and report to be placed “on hold” for a length of time while the representative claims to be researching the problem regarding the card in question.

In all complaints, any funds available on the card are drained while the victim is on hold or immediately after the call is disconnected.

Consumer Protection

Consumers should only use the website and phone number listed on the back of the MoneyPak prepaid cards. MoneyPak customer support can only be accessed by email request via the website’s online portal. The phone number listed on the back of MoneyPak cards is for adding funds to an existing prepaid card.

Green Dot customer service publicizes a customer service number; however, this number will not provide assistance with MoneyPak.

Currently identified fraudulent websites are not secured websites (http).The MoneyPak customer support website is a secured website (https) and does not require personal (date of birth, social security number) to reload a card, add money to PayPal or make payments to authorized partners. Prepaid card information is needed to reload a prepaid card on the valid MoneyPak website. Visit https://www.moneypak.com/ for more information.

Filing A Complaint

Individuals who believe they are a victim of a “MoneyPak Support” scam can file with the IC3 at http://www.ic3.gov. Please be as descriptive as possible, including prepaid card/account numbers affected and contact information of support “representatives”.

Because scams and fraudulent websites appear very quickly, individuals are encouraged to report possible internet scams and fraudulent websites by filing a complaint with the IC3 at http://www.ic3.gov.

Additional Information From MoneyPak.1

How to Stop A Scam

Tips On How To Protect Yourself From Fraud

- Never give your MoneyPak number to someone you don’t know

- Never give receipt information about your MoneyPak purchase to another party

- Use your MoneyPak only to reload your prepaid cards or accounts you control

- Refuse any offer that asks you to buy a MoneyPak and share the number or receipt information by email or phone

- To use your MoneyPak with PayPal or eBay or other online merchants, transfer the money to your PayPal account before you pay the merchant. Don’t email your MoneyPak number directly to any merchant

- Unless it’s an approved MoneyPak partner, don’t use MoneyPak for any offer that requires you to pay before you get the item

StealthGenie Mobile Device Spyware Application

StealthGenie is a mobile device spyware application (“app”) that is alleged to illegally intercept wire and electronic communications made using mobile phones.

What are mobile device spyware apps?

Mobile device spyware apps are developed for smart mobile phones and may allow a purchaser of the app to, amongst other things, secretly monitor a phone user’s communications and whereabouts. The purchaser must generally have physical access to a target mobile phone to install a mobile device spyware app, which is usually downloaded to the phone. Each phone software platform, such as Apple Inc.’s (“Apple”) iOs (for iPhones) and Google Inc.’s (“Google”) Android, require specific steps to complete the installation process.

How does StealthGenie work?

The StealthGenie app works in so-called “stealth” mode and is undetectable by most individuals. It is advertised as being untraceable. StealthGenie’s capabilities include the following:

- Call Recording: Records all incoming/outgoing voice calls or those specified by the purchaser of the app

- Call Interception: Allows the purchaser to intercept calls on the phone to be monitored while they take place, without the knowledge of the monitored smartphone user

- Recorded Surroundings: Allows the purchaser to call the phone and activate it at any time to monitor all surrounding conversations within a fifteen (15)-foot radius without the knowledge of the user

- Electronic Mail: Allows the purchaser to monitor the incoming and outgoing e-mail messages of user, read their saved drafts, and view attachments

- SMS: Allows the purchaser to monitor the user’s incoming and outgoing SMS messages

- Voicemail: Allows the purchaser to monitor the incoming voicemail messages

- Contacts: Allows the purchaser to monitor the entries in the user’s address book

- Photos: Allows the purchaser to monitor the photos on the user’s phone

- Videos: Allows the purchaser to monitor the videos on the user’s phone

- Appointments: Allows the purchaser to monitor the user’s calendar entries

The purchaser can review information transferred from the target mobile phone via an online portal. These intercepted communications are stored on the StealthGenie website. For example, a purchaser can log-in to the online portal to access information pulled from the user’s phone such as messages, e-mail, photos, and phone calls.

Can a person tell if a mobile device spyware app is on his or her phone?

Mobile device spyware apps are developed and advertised as being invisible to targets and act in an undetectable manner. For example, an app can be installed to look like another type of app or file, such as a digital photo application. Therefore, it will be difficult for the non-expert user to determine whether or not spyware is on his or her phone.

If a user is concerned about the potential presence of a mobile device spyware app on their phone, the only way to ensure that any app is permanently removed from the phone is to perform a “factory reset,” as described immediately below.

How can a mobile device spyware app be removed?

If you believe your phone may contain a mobile device spyware app, the best option is to conduct a “factory reset” of the phone. When a reset takes place, the phone is restored to its original condition (i.e., the condition at the time of purchase).

Please be advised that this means any and all data and apps installed after purchase will be removed from the phone, including all stored information. Please make sure to back-up any data you want to save from your phone before conducting a factory reset. Please note that performing a factory reset of a phone will not delete any information that has already been already collected from the phone by the mobile device spyware app from a vendor’s website.

Apple has provided information concerning how to perform a factory reset of an iPhone running the latest version of their mobile device operating system at http://support.apple.com/kb/HT1414 .

Because Google’s Android operating system is customizable by a phone manufacturer, please contact your phone’s manufacturer for instructions on how to factory reset your phone, or take it to the store from which you purchased the phone. Similar action should be taken to determine how to factory reset a non-iPhone or non-Android phone.

IRS Telephone Scam

There are reports related to a telephone scam in which the caller claims to be an Internal Revenue Service (IRS)representative. Using intimidation tactics, the caller tries to take control of the situation from the beginning.

The caller advises the recipient of the call that the IRS has charges against them and threatens legal action and arrest. If the recipient questions the caller in any way, the caller becomes more aggressive.

The caller continues to intimidate by threatening to confiscate the recipient’s property, freeze bank accounts, and have the recipient arrested and placed in jail. The reported alleged charges include defrauding the government, money owed for back taxes, law suits pending against the recipient, and non-payment of taxes.

The recipients are advised that it will cost thousands of dollars in fees/court costs to resolve this matter. The caller creates a sense of urgency by saying that being arrested can be avoided and fees reduced if the recipient purchases Moneypak cards to cover the fees within an hour.

Sometimes the caller provides specific instructions on where to purchase the Moneypak cards and the amount to put on each card. The caller tells the recipient not to tell anyone about the issue and to remain on the telephone until the Moneypak cards are purchased and the Moneypak codes are provided to the caller. The caller states that if the call is disconnected for any reason, the recipient would be arrested.

Some recipients reported once the caller obtained the Moneypak codes, they were advised that the transaction took too long and additional fees were required. Call recipients, who are primarily immigrants, reported that the caller spoke with broken English or stated the caller had an Indian accent.

If you receive a call similar to this follow these tips:

• Resist the pressure to act quickly

• Report the contact to TIGTA at http://www.treasury.gov/tigta by clicking on the red button, “IRS Impersonation Scam Reporting”

• Use caution when asked to use a specific payment method. The IRS would not require a specific payment method such as a Moneypak card or wire transfer

• If you feel threatened, contact your local police department

• File a complaint at www.IC3.gov

Internet Crime Complaint Center Scam

Cyber criminals posing as Internet Crime Complaint Center (IC3) employees are defrauding the public. The IC3 has received complaints from victims who were receiving e-mails claiming to be from the IC3.

Victims report that the unsolicited e-mail sender is a representative of the IC3. The e-mails state that a criminal report was filed on the victim’s name and social security number and legal papers are pending. Scammers impersonate an IC3 employee to increase credibility and use threats of legal action to create a sense of urgency. Victims are informed they have one to two days from the date of the complaint to contact the scammers.

Failure to respond to the e-mail will result in an arrest warrant issued to the victim.

Some victims stated they were provided further details regarding the ‘criminal charges’ to include violations of federal banking regulations, collateral check fraud, and theft deception. Other victims claimed that their address was correct but their social security number was incorrect. Victims that requested additional information from the scammer were instructed to obtain prepaid money cards to avoid legal action. Victims have reported this scam in multiple states.

If you receive this type of e-mail:

• Resist the pressure to act quickly

• Never wire money based on a telephone request or in an e-mail, especially to an overseas location

The IC3 never charges the public for filing a complaint and will never threaten to have them arrested if they do not respond to an e-mail.School Impersonation Scam

Subjects posing as school officials are defrauding retailers by purchasing large volumes of merchandise using fraudulently obtained lines of credit. Originally this scheme affected mostly office suppliers and computer retailers; however, recent successful attempts lead subjects to use this scheme against other retailers for industrial equipment, pharmaceuticals, safety and medical equipment.

How the Scheme Works

Step 1: A subject, posing as a school official, contacts a retailer’s customer service call center by telephone or e-mail. Using social engineering tactics, the subject attempts to gather additional information about the purchasing account. The subject typically terminates the phone call or e-mail session once sufficient information is gathered to place an order. Subjects also obtain account information from the school’s public website, if available.

Step 2: The subject makes a second contact with the target vendor, again representing himself as a school official and providing the account information obtained from step one. Billing to the school’s line of credit, the subject makes large purchases (such as laptops, routers, hard drives, printer toner, printer ink, medical supplies, and industrial equipment) with some orders totalling more than $200,000.

Step 3: During the purchase, the subject provides the customer service representative with a U.S. shipping address, typically belonging to a victim of a “romance scam” or “work from home” fraud scheme. A subject contacts the online scam victim and directs the individual to re-ship the office supplies to an address in West Africa, typically Nigeria, the United Kingdom, or to a U.S.-based storage or warehouse facility. To facilitate the re-shipment, the individual receives a shipping label prior to receiving the merchandise.

In a more recent variation of the scheme, the subject provides the true shipping address of the school he is claiming to represent. The subject then contacts the school, posing as an employee of the vendor, claiming that the products were shipped to the school in error. The school, believing it is returning the products to their rightful owner, reships the items to a domestic address provided by the subject.

Recruited individuals in the U.S. then re-ship the products overseas. What started with a small number of educational institutions has rapidly spread through copycatting and spoofing techniques to include some complaints reporting businesses instead of schools or universities being victimized.

E-mail Account Spoofing Techniques are used by subjects to place orders by establishing false school e-mail accounts, which appear similar to legitimate school e-mail addresses but lack the .edu extension. Below are variations of spoof email addresses:

• purchasingdept@unlav-edu.org

Once the fraud is discovered, the retailer absorbs the financial losses without recourse to the school.

To recruit the re-shippers, a subject, posing as an employer or romantic interest, gains the trust of individuals searching for employment opportunities or a romantic relationship. After a period of social engineering, the individuals are convinced to serve as money remitters or re-shippers on behalf of the subject.

Netflix Account Cancellation Scam

You may have recently received an account cancellation message claiming to be from online video streaming service Netflix. The message claims that, because of a problem processing your credit card, you must click a link to update card details to keep your account active.

The message is not from Netflix and you do not need to update credit card details as claimed. The message is a typical phishing scam and attempts to steal Login and Credit Card Details.

Clicking the 'update link' will take you to a fake webpage designed to look like the genuine Netflix site. Once on the fake page, you will be asked to provide your account login details, your credit card details, and, possibly, other personal information as well.

Online criminals will collect all of the information you submit on the fake page and can now commit credit card fraud in your name and gain access to your Netflix account. If they have been able to harvest enough of your personal information, they may also be able to steal your identity.

Phishing scammers regularly target Netflix customers and this version is just one of many similar phishing campaigns that have tried to trick Netflix customers into parting with their personal and financial information.

Be Cautious of 'Account Update' Messages.

Be wary of any unsolicited Netflix message that claims that you must update account details, rectify a billing issue, or prove your identity for security purposes.

And, scammers use very similar tactics to target customers of many other popular online services. If you receive such an 'update' message, do not click any links or open any attached file that it contains.

Don't Click Email 'Login' Links.

It is best not to click login links in emails. It is safest to login to all

of your online accounts by entering the account address into your browser's

address bar or via a trusted application associated with the service.

Google+ Scam

You may receive a poorly written phishing email claiming to be from the 'All Domain Mail Team' at Google's social network Google+.

It claims that the team is running a 'spam and fraudulent verification survey' and asks users to click a link to participate. It warns that if the verification survey is 'not gotten' within 24 hours, the team will assume that the recipient is a 'fraulent user' and his or her email account will be shut down.

The first sign that this is a scam email is the poor spelling and strange grammar. Another indicator would be that common sense would indicate that staff at Google+ would not be responsible for overseeing email security measures. Nor would they have the power to shut down email accounts. Maybe the scammers meant to specify 'Gmail' instead of 'Google+'.

If you click on the link it opens a website that simply requests users to login with their Google email address and password, supposedly to complete the verification process.

The login details will be collected by criminals and used to hijack the Google accounts belonging to the victims. The one set of login credentials can be used to access many different Google services. Thus, the criminals may be able to steal private information stored in various Google applications as well as use Gmail and Google+ accounts to launch further spam and scam campaigns.

Phishing scammers often try to trick users into submitting login details and other personal information by claiming that account details must be verified to improve security. Be wary of any unsolicited email that claims that you must click a link to verify or update your account or risk account suspension.

If you get one of these messages, do not click any links or open any attachments that it contains.Business Email Compromise

We been receiving complaints from businesses that were contacted fraudulently via legitimate suppliers’ e-mail accounts. Recipients were asked to change the wire transfer payment of invoices. Businesses became aware of the scheme after the legitimate supplier delivered the merchandise and requested payment. This scam has been referred to as the “business e-mail compromise.”

A twist to this scam that is being reported relates to the spoofed business e-mail accounts requesting unauthorized wire transfers. In the scheme, a business partner, usually chief technology officers, chief financial officers, or comptrollers, receives an e-mail via their business accounts supposedly from a vendor requesting a wire transfer to a designated bank account. The e-mails are spoofed by adding, removing, or subtly changing characters in the e-mail address that make it difficult to identify the perpetrator’s e-mail address from the legitimate address.

The scheme is usually not detected until the company’s internal fraud detections alert victims to the request or company executives talk to each other to verify the transfer was made.

The average dollar loss per victim is approximately $55,000. However, the IC3 has received complaints reporting losses that exceed $800,000.

There have been complaints from companies that were alerted by their suppliers about spoofed e-mails received using the company’s name to request quotes and/or orders for supplies and goods. These spoofed e-mails were sent to multiple suppliers at the same time. In some cases, the e-mails could be linked by Internet Protocol (IP) address to the original business e-mail compromise scams.

Because this latest twist is relatively new, the dollar loss has not been significant. Also, victim companies have a greater chance of discovering the scheme because the e-mails go to multiple suppliers that often follow-up with the company.

Based on analysis of the complaints, the scam appears to be Nigerian-based. Complaints filed contain little information about the perpetrators. However, subject information that was provided has linked to names, telephone numbers, IP addresses and bank accounts reported in previous complaints, which were tied over the years to traditional Nigerian scams.

Some commonalities found among the complaints include:

1. Victims are generally from the United States, England and Canada, although there have been complaints from other countries such as Belgium

2. Victim businesses often trade internationally, usually through China

3. Victim businesses that conduct high-dollar wire transfers, so requests for larger monetary amounts are not uncommonVisa Card Status Notification Scam

There is an email circulating that appears to be a 'Visa Card Status Notification' advising that access to the recipient's Visa card has been blocked. The message states that the account limits have been implemented because the Visa Card security department identified some unusual activity on the card.

The message invites the card owner to click on a link to resolve the issue and restore access.

The message is not from Visa and the claim that the account has been limited is not true. The email is a typical phishing scam designed to extract financial information from card owners.

The email's links open a fake website created to closely look like a genuine Visa webpage. The fake page will include a 'verification form' that requests users to supply their credit card number and other account details. After supplying the requested information, users will be taken to a second fake page that informs them that the problem has been resolved and restrictions have been removed.

Then victims may go about their business in the mistaken belief that they have rectified the problem with their card and all is well, however there was never any problem with the card to begin with. The criminals who have the card holders details can now commit fraudulent transactions via the Visa accounts of their victims.

These phishing scams are very common and continually target customers of major credit card providers and financial institutions all around the world. A well-worn phishing tactic is to claim that the recipient's account has been blocked or suspended and will claim that users can resolve this block by clicking a link - or in some cases opening an attached file - and filling in a verification form.

If you receive such an email, do not click any links or open any attachments that it contains.

Walmart Voucher Scam

An email being circulated claims you have accumulated $500 worth of Wal-Mart vouchers that have not yet been claimed. Supposedly, the vouchers were not sent because you have not confirmed your account details.

The message asks you to follow a link and supply your personal information so that the vouchers can be mailed out. Strangely, the message signs off as being from 'Tesco Personal Finance'.

However, the email is not from Wal-Mart (or Tesco) and the promised vouchers do not exist. If you click the link to claim the promised vouchers you will be taken to a fake web form that asks for your name and address details, social security number, phone number and email address. After supplying this information and pressing the 'Submit' button, you will be informed that the update process is complete and that the vouchers will be mailed to you in the next few days.

But, the vouchers will never come, and the criminals have already started accumulating personal information that may subsequently be used to commit identity theft and financial fraud.

The scammers now know a very valuable fact about the people who replied because they know they are vulnerable to falling for these types of scams and so may be directly targeted in further scams. They may receive 'follow up' emails that ask for more personal details and financial information such as credit card numbers.

Because the scammers now have the names and other personal data belonging to their victims, they can carry out personalized and specifically targeted phishing attacks that may appear quite legitimate.

The promise of unclaimed vouchers is a common scam so be wary of any message that suggests that you can claim unexpected vouchers or gift cards by clicking a link or opening an attached file and supplying personal information.

University Scam

There have recently been multiple scams targeting universities, university employees, and students across the USA. The scams range from Internet fraud to intrusions. The following are common scenarios:

• Spear phishing emails are being sent to university employees that appear to be from their employer. The email contains a link and claims some type of issue has risen requiring them to enter their log-in credentials. Once employees provide their user name and password, the scammer accesses the university’s computer system to redirect the employees’ payroll allocation to another bank account. The university employees’ payroll allocations are being deposited into students’ accounts. These students were hired through online advertisements for work-at-home jobs, and provided their bank account information to the scammers to receive payment for the work they performed

• Scammers are posting online advertisements soliciting college students for administrative positions in which they would receive checks via the mail or email. Students are directed to deposit the checks into their accounts, and then print checks and/or wire money to an individual. Students are never asked to provide their bank account information to the scammers

• Scammers are compromising students’ credentials resulting in the re-routing of their reimbursement money to other bank accounts. The reimbursement money is from student loans and used to pay tuition, books, and living expenses

• Scammers are obtaining professors’ Personally Identifiable Information (PII) and using it to file fraudulent income tax returns

• Some universities have been victims of intrusions, resulting in the scammers being able to access university databases containing information on their employees and students

Amazon Scam

There is an email circulating that claims to be from Amazon, and that it performs 'integrity checks' on customer accounts every six months. It claims that, if a customer's account is not used for longer than one month, it will first be disabled and then - after two months - removed completely.

To prevent this supposed problem, the message instructs customers to click a 'one time use' validation link, however the email warns the customer that the link is only active for 24 hours and if customers fail to 'make verification' within that time frame, their accounts will be disabled.

The email is not from Amazon and the claims are fake so the recipient does not need to click on the link. The message is a phishing scam designed to trick users into relinquishing their personal and financial data to Internet criminals.

The links in these scam messages typically lead to a fake webpage designed to look like a genuine Amazon page. The fake page asks users to provide their Amazon account login details as part of the verification process. After 'logging in' on the fake site, users may be taken to a second page that asks for their credit card details and other personal and financial information. If they supply the requested information, users may then receive a message claiming that their validation has been successful.

The scammers have now collected the information submitted on the fake forms and can use it to hijack Amazon accounts and commit credit card fraud.

A big warning sign in the email is the poor spelling and grammar. Amazon carries out most of its business online, so it is regularly targeted by phishing scammers.

Telephone Scam Alleging A Relative Is In A Financial Or Legal Crisis

There continues to be reports of telephone scams involving calls that claim their “relative” is in a legal or financial crisis. These complaints are sometimes referred to as the “Grandparent Scam.”

Scammers use scenarios that include claims of a relative being arrested or in a car accident in another country. Scammers often pose as the relative, create a sense of urgency and make a desperate plea for money to victims.

It is not unusual for scammers to beg victims not to tell other family members about the situation.

The scammers also impersonate third parties, such as an attorney, law enforcement officer, or some other type of official, such as a U.S. Embassy representative. Once potential victims appear to believe the caller’s story, they are provided instructions to wire money to an individual, often referred to as a bail bondsman, for their relative to be released.

Some complainants have reported the callers claimed to be from countries including, but not limited to: Canada, Mexico, Haiti, Guatemala, and Peru. Callers often disguise themselves by using telephone numbers generated by free applications or by spoofing their numbers.

If you receive this type of call:

• Resist the pressure to act quickly

• Verify the information before sending any money by attempting to contact your relative to determine whether or not the call is legitimate

• Never wire money based on a request made over the phone or in an e-mail, especially to an overseas location. Wiring money is like giving cash—once you send it, you cannot get it back.

Human Hair Scam

The demand for long hair, new hair styles, or hair to conceal a medical condition associated with hair loss is nothing new; however, it does appear the exploitation of human hair is on the rise.

Human hair is sometimes preferred by consumers over synthetic hair due to the natural look, feel, styling versatility, and longevity. Based on analysis of recent targets, it appears there is a fairly consistent overlap in the sale of human hair on websites that also sell counterfeit wearing apparel commodities.

A recent target domain was involved in the sale of counterfeit wedding dresses imported from China, as well as advertising human hair. This assessment identified 132 connected domain names referencing brand name shoes, bags, and dresses. An additional subject was also accused of selling fake hair, designer handbags, brand gym shoes, and boots.

Additionally, a company in China, selling counterfeit brand name shoes, advertises Peruvian, Brazilian, Indian, and Malaysian virgin hair. Virgin hair refers to hair that is completely unprocessed and intact. To qualify as virgin hair, it must meet rigorous standards including; not been permed, dyed, colored, bleached, or chemically processed in any way.

This also means it comes from a single donor, and all the cuticles are intact, running in the same direction. Usually, it also means that is has not been blow-dried, or exposed to harsh agents such as cigarette smoke and drugs.

The hair is being advertised as human; however, consumers are receiving synthetic hair after paying a substantially higher price for this authentic commodity.

Be sure to check the authenticity of the hair as well as the seller.

Callback Scheme In International Revenue Share Fraud

Telephone companies in the United States are seeing missed calls used to enable International Revenue Share Fraud (IRSF).

Fraudsters are using call generators with automated spoofing capabilities to place calls to a large volume of US cell phone numbers. The calls typically ring once. The number displayed on the recipient’s caller ID is a high cost international number, usually located in the Caribbean.

The recipient calls the number back and is greeted with a message designed to keep them on the line, such as “Hello, you have reached the operator, please hold.” The longer the caller stays on the line, the more revenue fraudsters generate.

Recipients do not realize they are calling an international number and that they will be billed for an international call. Businesses are also victims because recipients often use their work telephone to make the return call.

Telephone companies in the United States are charged when a return call is made because they are required to pay a fee to transfer calls to foreign countries. The payment is then shared with the fraudster who spoofed the calls. This is referred to as IRSF.

Area codes used in the spoofed numbers are from Anguilla, Antigua, Barbados, British Virgin Islands, the Commonwealth of Dominica, Grenada, Montserrat, and the Turks and Caicos Islands. These countries’ numbers are part of the North American Numbering Plan and do not require 011 to be dialed as with other international calls.

Recipients should not answer calls from numbers they do not recognize or initiate a return call. Recipients will not be charged for receiving the calls, however.

Companies that do not conduct business with companies in the above-mentioned countries may want to consider blocking these area codes to avoid this type of charge.Reshipping Job Opportunity

The job might look like a great opportunity, especially if you are unemployed. According to the job descriptions, which typically arrive via email or in response to a job profile posted online, all the job applicants need do to earn a generous wage is receive items, repackage them, and send them off to specified addresses.

However, the supposed job is in fact a reshipping scam designed to trick users into receiving the proceeds of crime. What the worker will actually be doing is accepting goods bought via fraudulent transactions and sending them back to the criminals responsible for the scam.

Why? Because, if a criminal steals your credit card details and uses them to buy various items, they need to have the items delivered somewhere and can't just have them delivered to their own address, because that could pinpoint their location to investigators and result in their arrest.

So, instead, the criminal needs to find a parcel mule to accept the fraudulently purchased items on their behalf. When police follow the trail, they will arrive at the door of the mule, not the real offender. Meanwhile, the criminal has had their goods shipped to themselves or more likely, sell them for cash.

In order to successfully purchase expensive merchandise with stolen payment cards and later sell for cash, fraudsters have to ensure that the mailing address matches the billing address. This obstacle is usually easily overcome by changing the billing address of stolen cards to the addresses of their hired, pre-assigned mules.

Another challenge for fraudsters in managing a successful reshipping operation is obtaining a seemingly innocent “drop” address where mules dwell. The most effective way to overcome this challenge is to recruit and hire mules that live in the United States. The United States is a strategic location for fraudsters in which to base their reshipping scams as many major online merchants who sell popular high-value goods do not ship their items outside of that country.

The reshipping mules can find themselves trapped inside the scam and at a loss as to how to get out. After a time, they may realize that they are involved in a scam, but by then, they may be scared to contact authorities out of fear of being charged with criminal activities, as well as their criminal "bosses" may threaten violence and retaliation to victims who try to get out themselves.

To make matters worse, the criminals may "pay" their mules with fake or stolen cheques or funds transferred from compromised accounts. They may instruct workers to deduct their wages and wire a remaining amount via a money transfer service such as Western Union. Thus, workers may be roped into laundering money as well as receiving stolen goods.

And mules are sometimes tricked into paying postage and other costs out of their own pockets, with a false promise that they will be later reimbursed.

In a variation of the tactic, criminals may find new and willing victims via online dating scams.

Be wary of any work-at-home job that requires you to receive various goods and reship them elsewhere. Any such request should be treated as suspect. If you have already become caught up in a parcel mule scam, you need to get yourself out immediately. The best course of action is to contact police and explain the situation.

Better than waiting for the police to arrive on your doorstep.

Holiday Shopping Tips

With the holiday season coming up, it is a timely reminder for holiday shoppers to beware of cyber criminals who are out to steal money and personal information. Scammers use many techniques to defraud you, from phishing e-mails offering too good to be true deals on brand-name merchandise to offering quick cash to victims who will re-ship packages to additional destinations.

While monitoring credit reports on an annual basis and reviewing account statements each month is always a good idea, you should keep a particularly watchful eye on your personal credit information at this time of year. Scrutinizing credit card bills for any fraudulent activity can help to minimize your losses. Unrecognizable charges listed on a credit card statement are often the first time you realize your personally identifiable information has been stolen.

Bank transactions and correspondence from financial institutions should also be closely reviewed. Bank accounts can often serve as a target for criminals to initiate account takeovers or commit identity theft by creating new accounts in your name. You should never click on a link embedded in an e-mail from your bank, but rather open a new webpage and manually enter the URL (web address), because phishing scams often start with phony e-mails that feature the bank’s name and logo.

When shopping online, make sure to use reputable sites. Often consumers are shown specials on the web, or even in e-mail offers, that look too good to be true. These sites are used to capture personally identifiable information, including credit card numbers, addresses and phone numbers to make fraudulent transactions. It’s best to shop on sites with which you are familiar and that have an established reputation as trusted online retailers, according to the MRC, a nonprofit that supports and promotes operational excellence for fraud, payments and risk professionals within eCommerce.

If you look for an item or company name through a search engine site, scrutinize the results listed before going to a website. Do not automatically click on the first result, even if it looks identical or similar to the desired result. Many fraudsters go to extreme lengths to have their own website appear ahead of a legitimate company on popular search engines. Their website may be a mirrored version of a popular website, but with a slightly different URL.

Purchases made on these sites could result in one or more of the following consequences: never receiving the item, having your credit card details stolen, or downloading malware/computer virus to your computer. Before clicking on a result in a search engine, inspect the URL of the destination website. Look for any misspellings or extra characters such as a period or comma as these are indicative of fraud. When taken to the payment page of a website, again verify the URL and ensure it is secure by starting with “HTTPS,” not just “HTTP.”

Here are some additional tips you can use to avoid becoming a victim of cyber fraud:

• Do not respond to unsolicited (spam) e-mail

• Do not click on links contained within an unsolicited e-mail

• Be cautious of e-mail claiming to contain pictures in attached files; the files may contain viruses. Only open attachments from known senders. Scan the attachments for viruses if possible

• Avoid filling out forms contained in e-mail messages that ask for personal information

• Always compare the link in the e-mail to the link you are actually directed to and determine if they match and will lead you to a legitimate site

• Log on directly to the official website for the business identified in the e-mail instead of “linking” to it from an unsolicited e-mail. If the e-mail appears to be from your bank, credit card issuer, or other company you deal with frequently, your statements or official correspondence from the business will provide the proper contact information

• Contact the actual business that supposedly sent the e-mail to verify that the e-mail is genuine

• If you are requested to act quickly or there is an emergency that requires your attention, it may be a scam. Fraudsters create a sense of urgency to get you to act quickly

• Remember if it looks too good to be true, it probably is.

Quantas Employment Scam

You may receive an email that appears to come from the Australian airline Qantas, advising you that the company currently has job vacancies in a range of areas. Interested applicants are invited to send their resumes to an email address listed in the message.

However, the email is not from Qantas and is an attempt to trick job hunters into making contact with online criminals. If you apply and send your resume you will soon receive a reply offering you a position with the company. The reply talks in glowing terms of excellent working conditions and high wages.

The message will also claim that, before you can start the exciting new job, certain prerequisites will need to be met. You will be told that you must pay upfront fees to cover various expenses such as a police or security clearance, training material, uniforms or equipment. Or you may be asked to send money so that the airline can arrange accommodation and travel for you. You may be told that the company will later reimburse any upfront fees you send.

Further requests for fees will continue until you finally realize that this is a scam, or you run out of funds to send. You will also be asked to provide a large amount of personal and financial information to verify your identity and allow you to be put on the company payroll. The information you provide may later be used to steal your identity.

In recent months, similar scam campaigns have claimed to offer jobs at various other high profile companies such as Disney Cruise Line, Radisson and Hilton.

Be wary of any unsolicited email offering you a job at a well-known company. In an attempt to make the emails look genuine, they often include stolen company logos as well as links that point to the genuine company website. Sometimes, they may also copy text from career information published on the company's website.However, large companies are very unlikely to send out bulk unsolicited job emails, and they certainly wouldn't do it via a free online webmail service rather than their own company domain.

Apple Account Frozen

You may receive an email which claims to be from Apple, stating that your Apple account has been frozen temporarily in order to protect it. The message warns that, unless you open an attached file to validate account information, the account will remain frozen.

However, your account has not been frozen. The email is the work of criminals intent on robbing you of your personal and financial data.

If you get taken in by the trick and open the attached file as instructed, a fake Apple account login page will appear in your browser.

Once "logged in" via the fake page, you will be taken to a second fake form that asks for identifying information and credit card details.

After clicking "verify" on the second fake form, you will be transported to the genuine Apple website and may remain unaware - at least for a little while - that your information is now in the hands of fraudsters.

Armed with the stolen data, the criminals can commit credit card fraud and identity theft. They can also hijack your real Apple account and use it for their own illegal purposes.

Apple, or other legitimate companies, will never ask customers to provide personal and financial information via an insecure HTML form contained in an email attachment. Scammers are more often using fake forms sent via email attachments rather than links to fake websites in an apparent attempt to bypass browser phishing warnings.

Scammers use FBI names

The FBI continues to be used by scammers by using FBI officials’ names and titles in online fraud schemes. Although there are different variations of these schemes, recipients are typically notified they have received a large sum of money.

The latest round of e-mails uses the name of new FBI Director James B. Comey.

Some of the e-mails continue to use the alleged “Anti Terrorist & Monetary Crimes Division” of the FBI. All e-mails encourage the recipient to send money for various reasons.

Do not respond. These e-mails are a hoax.

Neither government agencies nor government officials send unsolicited e-mail to members of the public. United States government agencies use the legal process to contact individuals.

You should not respond to any unsolicited e-mails or click on embedded links in these messages because they may contain viruses or malicious software.

If you have received a message that claims to be from the FBI, disregard its instructions and file a complaint at www.IC3.gov.

Beta Bot Malware Blocks Users Anti-virus Programs

There is a new type of malware known as Beta Bot. Cyber criminals use Beta Bot to target financial institutions, e-commerce sites, online payment platforms, and social networking sites to steal sensitive data such as log-in credentials and financial information.

Beta Bot blocks computer users’ access to security websites and disables anti-virus programs, leaving computers vulnerable to compromise.

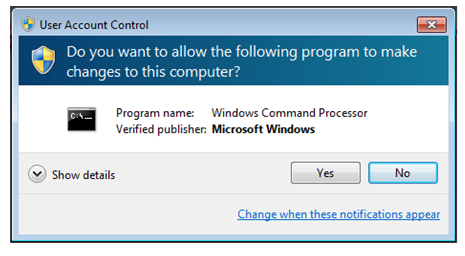

Beta Bot infection routes include a fake but official looking Microsoft Windows message box named “User Account Control” that requests a user’s permission to allow the “Windows Command Processor” to modify the user’s computer settings.

If the user complies with the request, the hackers are able to extract data from the computer. Beta Bot is also spread via USB thumb drives or online via Skype, where it redirects the user to compromised websites.

Although Beta Box masquerades as the “User Account Control” message box, it is also able to perform modifications to a user’s computer. If the above pop-up message or a similar prompt appears on your computer and you did not request it or are not making modifications to your system’s configuration, do not authorize “Windows Command Processor” to make any changes.

To remove the Beta Bot infection run a full system scan with up-to-date anti-virus software on the infected computer. If Beta Bot blocks access to security sites, download the latest anti-virus updates or a whole new anti-virus program onto an uninfected computer, save it to a USB drive and load and run it on the infected computer.

It is advisable to subsequently re-format the USB drive to remove any traces of the malware.

Spam: Delivering Malware and Advertising Dangerous Counterfeit Goods

Cyber criminals have long used spam (unsolicited e-mails, usually containing links to websites selling counterfeit goods) as a method to make money and infect computers with malicious software (malware.)

Spammers can send billions of these e-mails daily and some of them contain malware designed to steal usernames and passwords for online banking websites and harvest personal information such as names, addresses, or social security numbers.

Spam often takes the form of advertisements for illegal or counterfeit products. Buying these products is potentially harmful to the health and wellness of the purchaser because they are often low-quality or made with inferior materials.

Counterfeit drugs are not only less potent than the real drugs, but are also unregulated and potentially dangerous. Many contain unknown ingredients that can interact badly with other medications and cause serious or life-threatening side effects.

Cyber criminals can also send spam e-mails that seem to be from a trusted individual such as a bank representative, a website administrator, or an employee of a company. These e-mails often look like they come from the original source, but may have misspelled e-mail or website addresses. These e-mails try to get personal or financial information from the targeted recipients.

Cyber criminals are beginning to turn to other methods to deliver spam. Users of social media and social networking sites have begun to receive spam messages that often appear to be sent from trusted individuals or friends. Mobile devices are also becoming a target for spam and malware, usually being delivered through malicious applications. Cyber criminals can use this mobile malware to send text messages or harvest information about the phone or from the recipient’s contact list.

If you receive an e-mail that appears to be from a trusted source but are asked for personal or financial information, do not respond.

• Report the e-mail by calling or e-mailing the company’s customer service representatives. If the e-mail you are questioning is from your bank or credit card company, use the phone number on the statements you receive or the back of the credit card to get in touch

• Never respond to e-mails asking for personal or financial information unless you ensure they are legitimate

• Do not purchase products from spam e-mails, since they are very likely counterfeit and can be dangerous or deadly

• If you receive a spam e-mail or message on social media or social networking websites, delete it immediately and do not click any of the provided links. These can contain malware that can take control of your computer and steal personal information.

Pirated Software May Contain Malware

You decide to order some software from an unknown online seller. The price is so low you just can’t pass it up. Whether you’re downloading it or buying a physical disc, the odds are good that the product is pirated and laced with malicious software, or malware.

Is Your Software Pirated?

Possible signs of what to look for:

• No packaging, invoice, or other documentation...just a disc in an envelope

• Poor quality labeling on the disc, which looks noticeably different than the labeling on legitimate software

• Software is labeled as the full retail version but only contains a limited version

• Visible variations (like lines or differently shaded regions) on the underside of a disc

• Product is not wrapped correctly and is missing features like security tape around the edges of the plastic case

• Typos in software manuals or pages printed upside down

• User is required to go a website for a software activation key (often a ploy to disseminate additional malware)

Pirated software can be obtained from unknown sellers and even from peer-to-peer networks. The physical discs can be purchased from online auction sites, less-than-reputable websites, and sometimes from street vendors and kiosks. Pirated software can also be found pre-installed on computers overseas, which are ordered by consumers online and then shipped to your country.

Who’s behind this crime? Criminals, hackers and hacker groups, and even organized crime rings.

And the risks to unsuspecting consumers? For starters, the inferior and infected software may not work properly. Your operating system may slow down and fail to receive critical security updates.

But the greater danger comes from potential exposure to criminal activity—like identity theft and financial fraud—after malware takes hold of your system.